Table of Contents

Grey Shift

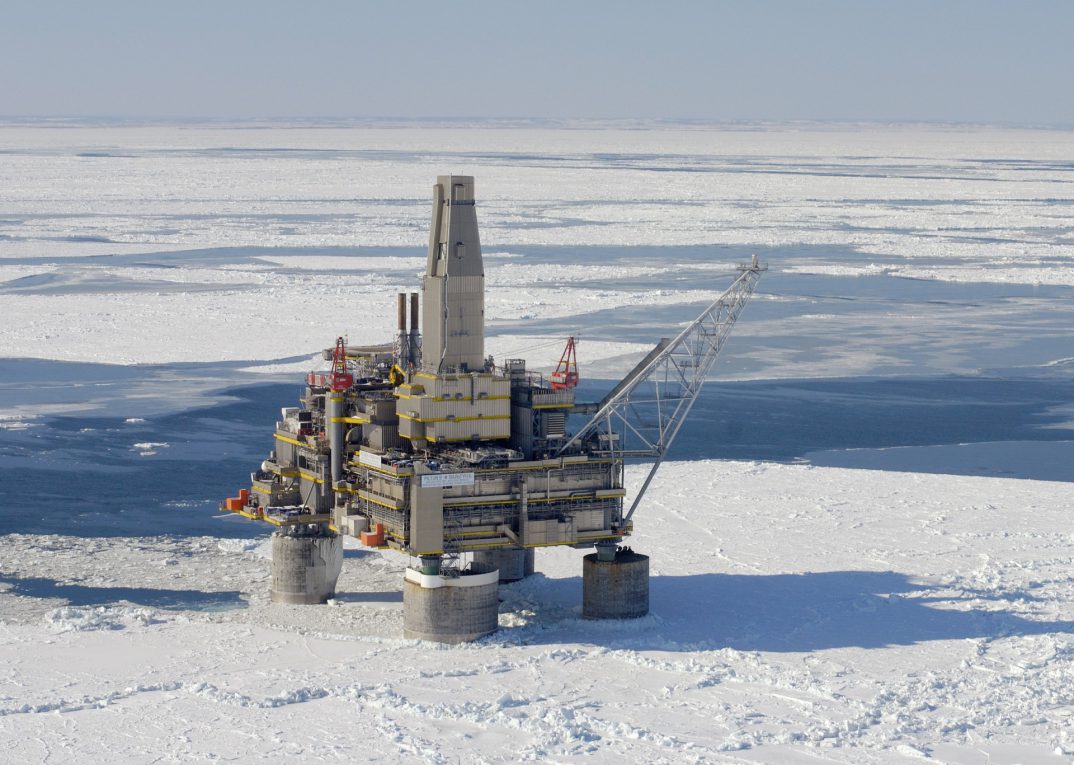

With OPEC+ set to roll over existing production cuts into Q2, the case of Russia is increasingly more complex. On top of a tightening sanctions regime, Russia is expected to make additional cuts of 471kbd on top of existing cuts of 500kbd, while current output levels stand at 9.5mbd for February according to government officials. These cuts are expected to include both crude and products and should help to keep Russian oil pricing firmly above the G7 price cap, particularly given higher benchmark brent prices. This comes as the Russian market is becoming increasingly more difficult for many players to get involved with; as sanctions enforcement increases, things could become even trickier going forward.

Recent months have seen increasing attacks against Russian oil infrastructure by Ukrainian drone forces. This has resulted in some high-profile facility shutdowns and disruptions to exports, most notably the Ust Luga and Tuapse plants, although Ust Luga is reportedly back online. The attacks on Russian energy infrastructure may continue as the war enters a new phase beyond the immediate area of conflict. Attacks on Russian refineries have also led to lower refinery runs and increased need for maintenance and repair at damaged facilities. There has also been an increase in Ukrainian naval drone operations in the Kerch strait and Crimean coast, which may pose an additional risk for vessels lifting Russian Black Sea cargoes on top of the threat of mines.

While this in theory should result in more crude for export as refining capacity remains offline, Urals prices as reported by pricing agencies remain above the $60/bbl price cap, limiting opportunities. On top of this, exporting Russian crude has become more challenging as more tankers and operators face sanctions and western owners increasingly pull back from engaging in this trade. Although overall crude export levels have remained steady since the start of the year, averaging 3.48mbd with the bulk of which heading to India and China, we have likely seen these flows peak.

The recent case of undelivered Sokol grade crude due to sanctions and payment issues has likely also made some buyers hesitant to increase their intake of Russian grades. The expectations of even further sanctions and compliance requirements going forward will add only further incentive to pull back from Russian linked oil trades.

What is this likely to mean for the mainstream tanker market? Firstly, if lower Russian export volumes materialise, buyers in India and China will be forced to seek replacement barrels from the Middle East and the Atlantic, which may lend support to the VLCC sector. However, the biggest impact is likely to be seen in the Suezmax and Aframax sectors, where a significant number of vessels, capable of trading Russian barrels and in the conventional trade, could migrate back into the mainstream market. This will also coincide with the easing of seasonal Turkish Straits delays, multiplying the downward pressure. Overall, tighter enforcement of price cap threatens to shake up the business model established since 2022, with the brunt of the impact felt by the mainstream market.

Russian Crude Pricing vs The G7 Price Cap ($/bbl)

Crude Oil

Middle East

We have just witnessed a real topsy turvy week in the AG VLCC market. The week got off to a flying start as a plethora of fresh cargoes caused rates to jump upwards into the ws 70’s levels for Eastbound cargoes and the tonnage supply for the earlier part of 3rd decade was extremely tight. However the market has now slowed as the pace of cargo flow diminished and by the end of the week rates began to soften and we are back below ws 70 again. However, we still have cargoes left to cover for March and any sudden burst in activity could push rates upwards again as the quantity of available ships has diminished. Today we are calling a 270,000mt AG/China run at ws 69 and 280,000mt AG/USG run is now at the ws 45 level.

Tonnage in the AG has begun to thin out; with relets still in play there are still ships around to prevent any rapid movement. For TD23 we estimate this today at 140,000mt x ws 67.5 via the Cape with potentially less available without options. To head East, a firm VLCC market has sheltered the Suezmaxes but still remains competitive and we rate this at around ws 117.5.

For the Aframax sector, it was a very quiet week on the whole. The Indo region showed some healthier signs in the early stages of the week, which has perturbed a few ballasting towards the AG. However, with a few vessels still searching for the elusive AG/East only run, pressure is mounting and rates might drop below 80,000mt x ws 190 for a straight run soon.

West Africa

VLCC rates in WAF pushed upwards at the beginning of the week in reaction to the activity in the AG. There now appears to be a softer tone as we head into the weekend and rates are again under downward pressure especially with weak enquiry levels to contend with. On the plus side for owners, the tonnage list is not too excessive so any pick up in volume should keep rates steady for now. Today we are expecting a WAF/China run to fix at the ws70 level

Suezmax markets in West Africa are firming off the back of a busier USG market, Owners today will be asking more than 130,000mt x ws 115 but this market needs a fresh test.

Mediterranean

TD6 has seen some under-the-radar fixing this week, and with better prospects in the Atlantic for Owners to consider we approximate TD6 today at 135,000mt x ws 117.5. There is a slightly tighter list for ships willing to head East, and rates are around $5.3M for Libya/Ningbo via the Cape.

Owners were in the driving seat at the start of this week as they looked to recover some of the recently lost market value. A tight list of Ceyhan-approved players helped and by the end of the week, the market had risen to ws 155 for a X-Med voyage. With a busy third decade fixing window expected, both Charterers and Owners will need to monitor the list carefully as we look into next week.

US Gulf/Latin America

It was a mixed bag for VLCC owners in this region as some gains were made during the early part of the week from the USG but after a few cargoes entered and then withdrew from market, owners confidence was dented and we are currently seeing downward pressure on rates. The Brazilian export market was more consistent and some gains were made especially off earlier dates. Today, we expect a USG/China run will fix in the region of $9M while we estimate a Brazil/China run is paying around ws 69 level.

North Sea

Despite rates in surrounding markets increasing, the North has stayed comparably flat with ws 125 levels being repeated in the region for a X-Nsea voyage. Looking ahead into next week we expect more of the same, with activity being met with healthy amount of offers and those non local players looking to ballast away from the region to the USG for employment.

Crude Tanker Spot Rates (WS)

Clean Products

East

The LRs have had a more productive week with pre-Ramadan activity both stemming the decline and facilitating a small bounce back. LR1s saw Westbound start the week at $3.80M and hit $4.0M by Friday. TC5 has pushed up and 55,000mt Naphtha AG/Japan now sits at ws 185. Short hauls have also been active and seen added volume due to MR stems needing cover.

LR2s have been busier and the rapid falls of the last few weeks have finally been arrested. TC1 has climbed back from the low of 75,000mt at ws 145 to ws 155 and more is now likely. 90,000mt Jet AG/UKC saw $4.45 million paid but nothing below $4.75M is now available. March has seen increased volume also from the Far East and with no sign of the Houthis calming down soon, Cape routings will continue to keep tonne miles high and future freight will likely be held higher accordingly.

Despite a slower start to the week than Owners would have hoped for, the MRs East of Suez saw a flurry of activity mostly on TC17 midweek that clipped away the vast majority of firm ballast tonnage. This activity left the market on a knife edge where, had the questions continued to flow, EAFR would have been demanding + ws 330 on both natural dates and the forward window. Closing the week, the MR list looks tight up to 20th largely driven by the continuing delays on vessels performing X-AGs. With a more subdued end to the the week, the levels we see come Monday could be very much date dependent with firm units tight.

The North Asia MR market had gone through a slow week. MR cargo volume was low partly because of a large number of LR liftings. The window was full of ballasters either from the USWC or OZ. The benchmark Korea/Spore route dropped around $200k to $1.25M and Korea/OZ 22.5 points to ws 357.5. Tonnage remains over-supplied still and more downwards correction is expected. The Singapore region faced less pressure as better earning in the North Asia took away a few units. Tonnage looked in balance with quite a few units having uncertain discharge options. The benchmark TC7 run only dropped 2.5 points to ws 327.5.

Mediterranean

All in all it’s been a steady week for the handies here in the Mediterranean with rates trading sideways throughout. A mixture of good enquiry and a well-balanced list has kept X-Med stable at the 30,000mt x ws 320 mark all week with BSea/Med tracking at its usual +40 point premium. However, at the time of writing enquiry levels have started to pick up and with the list growing tighter there is potential for some improvement here.

Finally to the Med MR’s where it’s been an up and down week with rates tumbling but then rebounding. We began the week with Med/TA trading at 37,000mt x ws 295 but with the list well-supplied and TC2 pressured it was only a matter of time before the Med followed suit. Tuesday saw a drop of 50 points to 37,000mt x ws 245 and then a low of 37,000mt x ws 232.5 was finally reached on Thursday. Since then however we saw a big influx of cargoes into the market and with ships being taken out of the market, the list grew tight once more with rates able to rebound to 37,000mt x ws 240. Heading into the weekend not a great deal remains to cover but with the front-end tight expect Charterers to hold off quoting till Monday if they can.

UK Continent

MRs have been the thorn in handy Owners side this week as they looked to compete on short haul cargoes as the 37kt clips softened on long haul. XUKC closes at 30,000mt x ws 240 but with the MRs picking up towards the end of the week and the handy list tightening, owners will be hopeful for a bounce back.

It was a volatile week on the MRs in NWE. With the list bulked out with laden tonnage as we started Monday morning, in turn we saw the market fall from ws 230 a week prior all the way to the ws 172.5 level for TC2 by Wednesday. Activity has been there for the most part and now that most of the tonnage has gone, we have seen a bounce back on levels come Friday morning with ws 185 on subs for TC2. Combining a tight TC2 list now in play and USG/MED markets looking good, we are doubtful the North will be re-supplied much come next week and the expectation is for rates to be on an upwards trajectory if volume remains.

Clean Tanker Spot Rates (WS)

Dirty Products

Handy

This week started strong in the North, with cargo enquiry clipping away the front end of the list. However, this pace fell off almost immediately, creating a sluggish feel for the week’s balance. Low levels of enquiry and ample available tonnage has left sentiment relatively soft, with the potential to see levels tested early next week.

In the Med, we initially saw an injection of pace, clearing most units at the top of the list. However, with prompt availability throughout the week, the inevitable happened: Owners succumbed to negative pressure, and as a result, we saw levels drop to ws 255 by the end of the week. Going forward, Owners are resisting less than ws 255 for now, but the recent lack of activity will prove a tough task for them.

MR

There has been little opportunity for MRs this week in the North, but that is no surprise due to current availability, which is in short supply. Levels were tested basis 45kt, which resulted in 45,000mt x ws 220, but full stem enquiry failed to surface again this week which has left this sector feeling pretty flat.

In the Med, MRs continued to steadily find employment this week, albeit mainly part cargo opportunity, which kept the region ticking over. Despite the recent softening of handies, Owners who found 45kt stems managed to maintain the last done at ws210.

Panamax

Minimal units are available right now, and with the recent lack of enquiry in Europe, certain Owners have already chosen to ballast their units West in search of better earnings.

Dirty Product Tanker Spot Rates (WS)

Rates & Bunkers

Clean and Dirty Tanker Spot Market Developments – Spot WS and $/day TCE (a)

| wk on wk change | Mar 7th | Feb 29th | Last Month* | FFA Q1 | |

| TD3C VLCC AG-China WS | +12 | 72 | 60 | 66 | 67 |

| TD3C VLCC AG-China TCE $/day | +14,500 | 45,250 | 30,750 | 38,250 | 39,500 |

| TD20 Suezmax WAF-UKC WS | -1 | 103 | 104 | 103 | 115 |

| TD20 Suezmax WAF-UKC TCE $/day | -500 | 34,250 | 34,750 | 34,750 | 41,750 |

| TD25 Aframax USG-UKC WS | +8 | 201 | 193 | 192 | 209 |

| TD25 Aframax USG-UKC TCE $/day | +3,000 | 47,750 | 44,750 | 44,500 | 50,750 |

| TC1 LR2 AG-Japan WS | +7 | 152 | 145 | 262 | |

| TC1 LR2 AG-Japan TCE $/day | +2,750 | 29,000 | 26,250 | 68,500 | |

| TC18 MR USG-Brazil WS | +73 | 307 | 234 | 234 | 233 |

| TC18 MR USG-Brazil TCE $/day | +14,000 | 40,500 | 26,500 | 26,250 | 26,000 |

| TC5 LR1 AG-Japan WS | -1 | 173 | 174 | 296 | 239 |

| TC5 LR1 AG-Japan TCE $/day | -250 | 24,500 | 24,750 | 56,750 | 41,750 |

| TC7 MR Singapore-EC Aus WS | -17 | 325 | 342 | 343 | 307 |

| TC7 MR Singapore-EC Aus TCE $/day | -3,000 | 39,500 | 42,500 | 42,750 | 36,250 |

(a) based on round voyage economics at ‘market’ speed, non eco, non scrubber basis

Bunker Price s ($/tonne)

| wk on wk change | Mar 7th | Feb 29th | Last Month* | |

| Rotterdam VLSFO | +2 | 581 | 579 | 565 |

| Fujairah VLSFO | +16 | 646 | 630 | 609 |

| Singapore VLSFO | -2 | 634 | 636 | 630 |

| Rotterdam LSMGO | -17 | 753 | 770 | 801 |